EMPLOYER || CANDIDATE

EMPLOYER || CANDIDATE

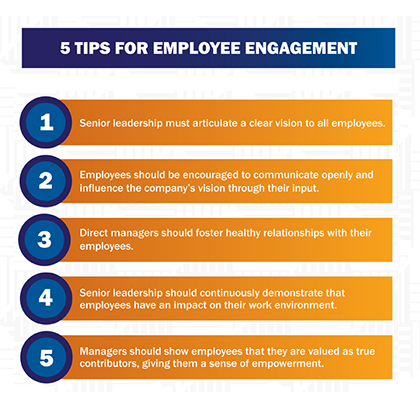

HR Planning

Employer

HR Calculator: Cost & Rate

How to determine various key cost and rate calculations.

How Much Does an Employee Cost?

Each employee costs the sum of his or her gross wages. This is in addition to other employee-related expenses, including state payroll taxes, Social Security and Medicaid taxes, and the cost of benefits (insurance, paid time off, and meals or equipment or supplies).

How to Calculate Labor Cost per Hour

Calculate an employee's labor cost per hour by adding their gross wages to the total cost of related expenses (including annual payroll taxes and annual overhead), then dividing by the number of hours the employee works each year. This will help determine how much an employee costs their employer per hour.

But let’s say an employer spends an additional $8,000 on that employee throughout the year. Add $8,000 and $31,200 to get $39,200. Now, divide $39,200 by the number of hours the employee will actually work in a year (about 1,960) to calculate the true hourly rate of that employee. In this example, the total hourly cost of that employee is closer to $20 per hour.

How to Calculate the Labor Cost Formula

The labor cost formula takes into account an employee’s hourly wages, the hours they work in a week, and the weeks they work in a year. An employer’s overhead cost per employee is also considered, in addition to the employer’s annual taxes. Each cost is added together and then divided by the employee’s hours worked per year.

What Is the Cost of Labor?

The cost of labor is the sum of each employee's gross wages, in addition to all other expenses paid per employee. Other expenses include payroll taxes, benefits, insurance, paid time off, meals, and equipment or supplies.

How to Calculate True Overhead Rates

Knowing the true cost of an employee is one thing, but if you're not including the cost of overhead in your equation, you could be under-billing your clients and losing money! Knowing how to accurately calculate the cost of overhead for each employee will help you determine what to charge and how to remain profitable.

Start by determining the true cost of your employees.